Latest Fintech Trends in 2025: Embedded Finance, Open Banking Technology, and Fintech Startups to Watch

Estimated reading time: 12 minutes

Key Takeaways

- Embedded finance integrates seamless financial services into digital platforms, creating frictionless user experiences.

- Open banking technology enables secure data sharing and payment APIs under evolving regulations.

- AI-driven autonomous finance powers hyper-personalization and automation in financial advice and risk management.

- Real-time payments and digital wallets are becoming global standards for fast, convenient transactions.

- Fintech startups continue to innovate, driving the sector forward across embedded finance, open banking, AI, payments, and digital assets.

- Tracking fintech news is essential for investors, professionals, and enthusiasts to stay competitive and spot opportunities.

Table of Contents

- 1. Introduction to Latest Fintech Trends in 2025

- 2. Overview of the Latest Fintech Trends Shaping 2025

- 3. Embedded Finance: Frictionless Financial Services in Digital Platforms

- 4. Open Banking Technology: Secure Data Sharing and Payment APIs

- 5. Fintech Startups to Watch: Innovation Driving the Sector Forward

- 6. Importance of Following Fintech News for Competitive Advantage

- 7. Conclusion: Staying Ahead with the Latest Fintech Trends

- Frequently Asked Questions

1. Introduction to Latest Fintech Trends in 2025

Fintech, short for financial technology, refers to technology-driven innovation in financial services. It covers a wide range of areas including payments, lending, wealth management, and insurance. Over recent years, fintech has grown rapidly, disrupting traditional banking models and creating new digital experiences for consumers and businesses alike.

The impact of fintech is profound. Markets are expanding swiftly, driven by advances in software, mobile technologies, and cloud computing. Consumers now expect faster, easier, and more personalized financial services. Businesses benefit from flexible, integrated financial tools that streamline operations and unlock new revenue streams.

Staying informed about the latest fintech trends is essential. This blog will explore the key trends shaping 2025 and explain why they matter.

Why is keeping up with fintech news crucial?

- Investors use it to identify promising growth themes and potential exit opportunities.

- Industry professionals leverage trend insights to refine products, navigate compliance, and stay competitive.

- Enthusiasts and career seekers track fintech innovations to find new apps, services, or job openings.

The fintech landscape changes fast, and understanding the latest fintech trends is vital for anyone connected to the sector.

Sources:

WNS Perspectives: The Future of Fintech Six Trends Defining 2025

World Economic Forum: The Future of Global Fintech 2025

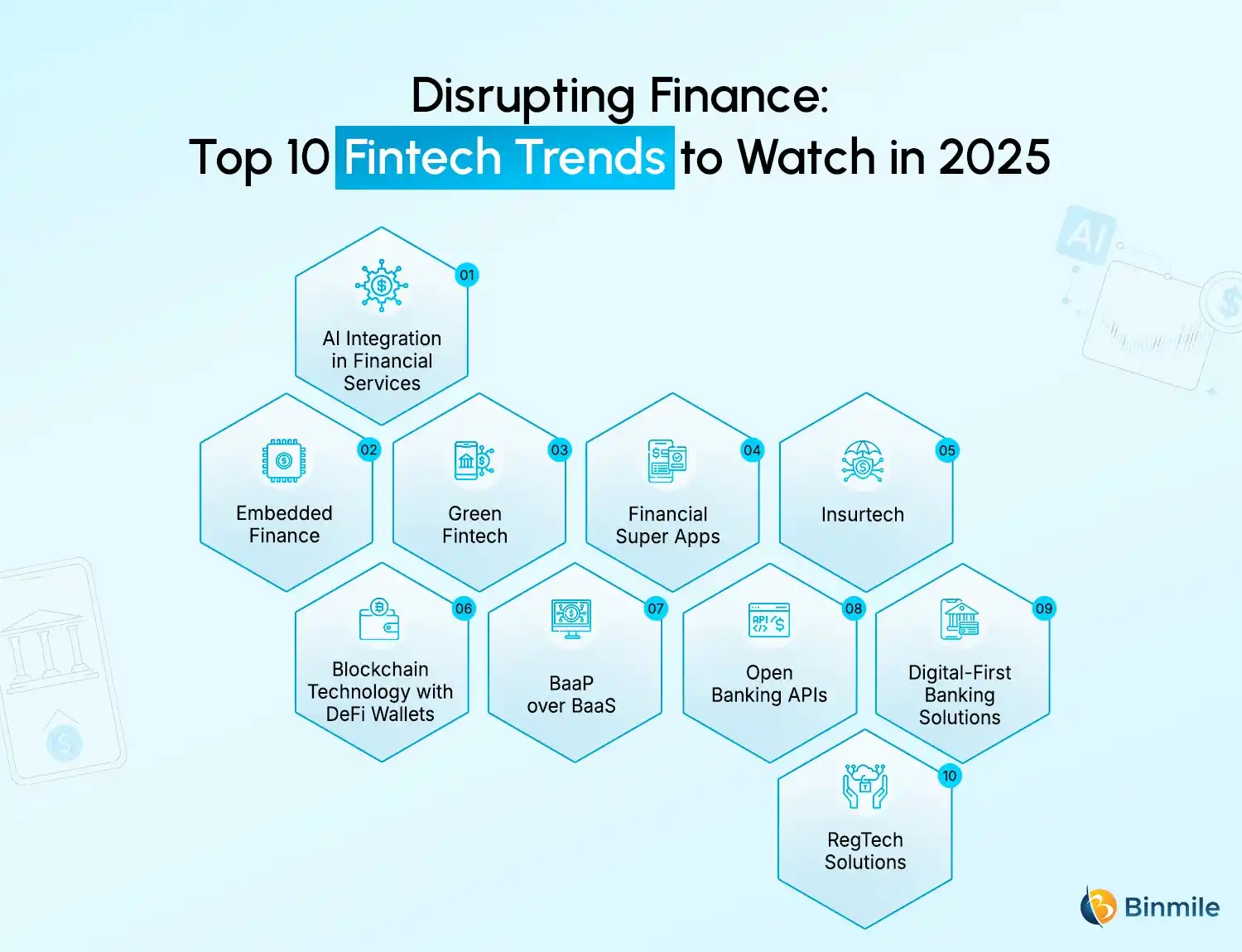

2. Overview of the Latest Fintech Trends Shaping 2025

In 2025, several major fintech trends dominate the market. Understanding these will help stakeholders anticipate changes and seize opportunities:

- Embedded finance: Integrating financial services such as payments and lending directly into non-financial platforms like e-commerce, SaaS, and marketplaces.

- Open banking technology and open finance: APIs facilitating secure data sharing and payment initiation with licensed third parties.

- AI-driven and autonomous finance: Artificial intelligence powering hyper-personalized financial advice, automated risk management, and process automation.

- Real-time payments and digital wallets: Becoming standard payment methods around the globe, accelerating transaction speeds and convenience.

- Digital assets and tokenization: Increasing adoption of stablecoins, central bank digital currencies (CBDCs), and asset tokenization methods for liquidity and transparency.

Why track these latest fintech trends? Because they directly affect product design, regulation, competitive landscapes, fees, accessibility, and user experience. Monitoring these developments enables businesses and investors to anticipate shifts and capitalize on emerging markets.

Credible research sources confirm these trends as vital market drivers:

– Juniper Research: Top 10 Fintech Payments Trends 2025

– Innowise Blog: Fintech Trends

– WNS Perspectives: The Future of Fintech Six Trends Defining 2025

3. Embedded Finance: Frictionless Financial Services in Digital Platforms

Embedded finance means weaving financial services—such as payments, lending, banking, and insurance—seamlessly into non-financial digital platforms like e-commerce websites, ride-hailing apps, B2B SaaS products, and online marketplaces.

This integration creates frictionless financial experiences, including:

- One-click checkouts that reduce cart abandonment.

- Buy-now-pay-later (BNPL) options improving purchasing power.

- In-app lending and merchant financing supporting cash flow. Source

- Subscription billing simplifying recurring payments.

Platforms benefit from new revenue streams and increased user engagement by embedding these financial features.

Current applications highlight embedded finance’s role in SME lending and working capital solutions. For instance, platforms like Froda offer lending tools embedded directly inside B2B marketplaces to help small businesses manage immediate cash needs.

Banking-as-a-Service (BaaS) models support embedded finance by enabling retailers and SaaS companies to launch branded financial products such as accounts and cards without building banking infrastructure from scratch.

Embedded finance is evolving from simple point solutions to comprehensive financial ecosystems. These ecosystems rely on modular, composable architectures and increased cooperation—dubbed “coopetition”—between banks and fintech companies rather than pure disruption.

In the future, sector-specific embedded finance will grow strongly, targeting industries like the creator economy, logistics, and healthcare. Though this will attract regulatory scrutiny around risk-sharing and compliance, experts estimate embedded finance could generate hundreds of billions of dollars in revenue by 2030.

Sources:

Innowise Blog: Fintech Trends

WNS Perspectives: The Future of Fintech Six Trends Defining 2025

4. Open Banking Technology: Secure Data Sharing and Payment APIs

Open banking technology refers to regulated application programming interfaces (APIs) that enable customers to securely share their bank data and initiate payments through licensed third-party providers.

This model relies on regulations like PSD2 (Payment Services Directive 2) and the upcoming PSD3 in the EU and UK, which mandate banks to open access to customer data securely on consent.

Open banking regulations are expanding to broader open finance frameworks that cover pension data, payroll, investment accounts, and tax information, aiming to offer consumers a complete, connected financial picture.

Open banking enables several key innovations:

- Account aggregation apps provide unified views of multiple accounts and financial products.

- Enhanced credit and risk scoring models utilize richer, more detailed transactional data. Source

- Instant account-to-account (A2A) payments offer faster, more affordable alternatives to traditional card payments.

However, open banking faces challenges:

- Security risks and managing user consent remain critical.

- Determining liability and responsibility in case of fraud or errors is complex.

- Monetization models for banks and fintechs in API ecosystems are still evolving.

- Adoption varies widely across geographies due to fragmented standards and regulatory frameworks.

Despite these hurdles, open banking technology is set to remain a cornerstone of fintech innovation.

Sources:

Innowise Blog: Fintech Trends

KPMG Pulse of Fintech: Top Fintech Trends

World Economic Forum: The Future of Global Fintech 2025

5. Fintech Startups to Watch: Innovation Driving the Sector Forward

The latest fintech trends are fueled by dynamic startups across key segments. Below are representative fintech startups to watch in 2025, grouped by trend.

Embedded Finance / BaaS Startup

- Example: A startup like Marqeta offers plug-and-play platforms for issuing cards, lending, and accounts to non-financial brands.

- Focus: Empower retailers, SaaS providers, and platforms to embed financial products seamlessly.

- Impact: Accelerates embedded finance ecosystems by reducing time to market.

- Updates: Recent funding rounds have pushed valuation into billions, with partnerships across banking networks. Source

Open Banking / Open Finance API Platform

- Example: A firm like Plaid aggregates banking, wealth, payroll, and investment data via APIs.

- Focus: Supports fintech developers and banks by enabling data-driven services.

- Innovations: Enables new personal finance management and digital lending products.

- Milestones: Expanded coverage into international markets with enhanced security certifications.

AI-Driven Autonomous Finance App

- Example: An app like Cleo uses agentic AI to automate budgeting, optimize investments, and accelerate debt payoff tailored to individual goals.

- Trends Hit: Hyper-personalization and automation in finance. Source

- Growth: User base expanding rapidly with significant venture capital backing.

Real-Time Payments Infrastructure Provider

- Example: A fintech like Apex Clearing simplifies the integration of RTP rails for banks and digital platforms.

- Purpose: Makes real-time payments a standard infrastructure allowing instant settlements.

- Strategic Moves: Collaborations with regional payment networks to increase reach.

Digital Asset / Tokenization Platform

- Example: Companies such as Circle enable tokenization of assets and compliant stablecoin issuance.

- Sector Role: Bridging traditional finance and blockchain-based innovation.

- Regulatory Milestones: Achieved key licenses to operate in multiple jurisdictions.

These fintech startups embody the latest fintech trends and are shaping the future of financial services through innovation, collaboration, and regulatory engagement.

Sources:

Innowise Blog: Fintech Trends

WNS Perspectives: The Future of Fintech Six Trends Defining 2025

FinTech Magazine: Growth of Fintech Innovations in 2025

6. Importance of Following Fintech News for Competitive Advantage

Monitoring ongoing fintech news is critical in a market that evolves quickly due to regulatory changes, funding cycles, and technology breakthroughs.

- Regulations around open banking, stablecoins, and CBDCs often shift rapidly, impacting valuations and business strategies. Source

- New funding rounds spotlight emerging fintech startups to watch and reveal shifting innovation hotspots. Source

- Keeping informed enables early awareness of breakthroughs, providing a competitive edge for investment decisions and product development.

Recommended sources to stay current:

- Specialist fintech news sites and trade magazines with daily or weekly briefings.

- Data-driven consulting and Big Four reports offering deep, long-term trend analysis.

- Central bank and regulatory updates focusing on open banking, CBDC policies, and digital asset regulations.

- Venture capital and accelerator blogs highlighting promising startups and investment flows.

- Podcasts, newsletters, and conference summaries offering expert insights.

Different stakeholders use fintech news in tailored ways:

- Investors build deal pipelines and time entry or exit points effectively.

- Founders and product teams spot new use cases, partnership opportunities, and potential regulatory hurdles. Source

- Professionals and job seekers align skills and career paths with evolving market needs in AI, compliance, or data analytics.

Following fintech news ensures stakeholders remain informed and ready to act in a rapidly shifting landscape.

Sources:

KPMG Pulse of Fintech: Top Fintech Trends

Boston Consulting Group: Fintech Scaled Winners and Emerging Disruptors 2025

Digital Silk: Fintech Trends Statistics

7. Conclusion: Staying Ahead with the Latest Fintech Trends

This article detailed the latest fintech trends defining 2025:

- Embedded finance delivering seamless financial products within digital platforms.

- Expanding open banking technology and the transition to open finance.

- AI-powered finance solutions enabling hyper-personalization and automation.

- The rise of real-time payments and digital wallets as the default instruments.

- Vibrant fintech startups to watch innovating across these dimensions.

The fintech sector remains highly dynamic, driven by technological innovation, shifting regulation, and evolving consumer expectations. For stakeholders to thrive, regularly following reputable fintech news sources is essential.

Track macro-level developments like regulation changes, AI trends, and digital asset adoption alongside micro-level signals such as new product launches and startup funding. Staying informed and curious will position readers to capitalize on the fast-growing opportunities in the fintech market.

Sources:

WNS Perspectives: The Future of Fintech Six Trends Defining 2025

KPMG Pulse of Fintech: Top Fintech Trends

World Economic Forum: The Future of Global Fintech 2025

Frequently Asked Questions

- What is embedded finance and why is it important?

Embedded finance integrates financial services directly into non-financial platforms, creating smoother experiences for users and new revenue opportunities for businesses. It reduces friction in payments, lending, and insurance processes.

- How does open banking technology impact consumers?

Open banking allows consumers to securely share their financial data with licensed third parties, enabling personalized financial products, improved credit scoring, and faster payments. It fosters transparency and innovation in financial services.

- Which fintech trends should investors watch in 2025?

Key trends include embedded finance, AI-powered autonomous finance, real-time payments, and digital asset tokenization. Startups innovating in these spaces represent promising investment opportunities aligned with market growth.

- Why is following fintech news critical for industry professionals?

Because the fintech landscape evolves quickly, staying current helps professionals adapt to regulatory changes, spot competitive threats, adopt new technologies, and identify partnership opportunities essential for success.

- How are AI and fintech intersecting in 2025?

AI drives hyper-personalized financial advice, automated risk management, and process automation. Autonomous finance apps are expanding, making services more adaptive and efficient.

By understanding and following the latest fintech trends, you will be well-positioned to navigate the evolving landscape and seize the next wave of digital financial innovation.