Neobanks vs Traditional Banks: A Complete Guide to Choosing the Right Banking Option

Estimated reading time: 12 minutes

Key Takeaways

- Neobanks vs traditional banks offer distinct banking experiences tailored to different lifestyles and financial needs.

- Traditional banks provide trusted, full-service financial products with physical branches and personalized support.

- Neobanks excel in low fees, high APYs, fast digital access, and innovative AI-driven tools.

- Understanding the digital bank comparison is key to choosing the right fit.

- Evaluate the online banking pros cons and your personal preferences when deciding.

Table of Contents

- Overview of Traditional Banks

- Overview of Neobanks

- Neobanks vs Traditional Banks: Key Differences

- Digital Bank Comparison: Feature-by-Feature Analysis

- Online Banking Pros and Cons: What You Need to Know

- How to Choose Between a Neobank and a Traditional Bank

- Conclusion: Making the Right Bank Choice For You

- Frequently Asked Questions

Overview of Traditional Banks: The Established Financial Institutions

Traditional banks have a long history as licensed financial institutions. Rooted in centuries of managing deposits, loans, and payments, these banks have adapted over time into full-service providers regulated by government bodies (source: sofi.com).

Common Services Offered by Traditional Banks

- Checking and savings accounts

- Credit cards and personal loans

- Mortgages and home equity loans

- Business banking solutions

- Investment and wealth management products

- Physical offerings like safe deposit boxes

- Network of physical branches and ATMs to handle cash and in-person services

The Customer Experience at Traditional Banks

Customers often visit branches to interact with tellers who manage cash deposits, process complex transactions, and provide personalized financial advice. This face-to-face contact fosters long-term relationships and builds trust.

Traditional banks excel in delivering a comprehensive range of financial products and services because of their established infrastructure and regulatory backing (source).

For detailed insights on fintech regulation that also affects these institutions, see fintech regulations and automation trends.

Overview of Neobanks: The Digital-Only Innovators

Neobanks are fintech companies that operate exclusively online. Emerging in the 2010s, they deliver banking services through mobile apps and websites, without physical branches (sofi.com; emarketer.com).

Why Neobanks Are Rising

By cutting costs associated with branches and physical infrastructure, neobanks can offer customers low or no fees and often provide higher interest rates on deposits (diro.io).

Unique Features of Neobanks

- Early paycheck access, sometimes offering funds before the official payday

- Fee-free overdraft protection

- AI-powered personalized financial tools and budgeting assistants

- 24/7 app-based access enabling banking anytime, anywhere

- Fast account setup processes that often bypass traditional credit checks

Users attracted to technology-driven solutions and cost savings find neobanks compelling alternatives to conventional banks (source). The rise of AI tools related to finance apps is also discussed in harnessing generative AI tools for productivity.

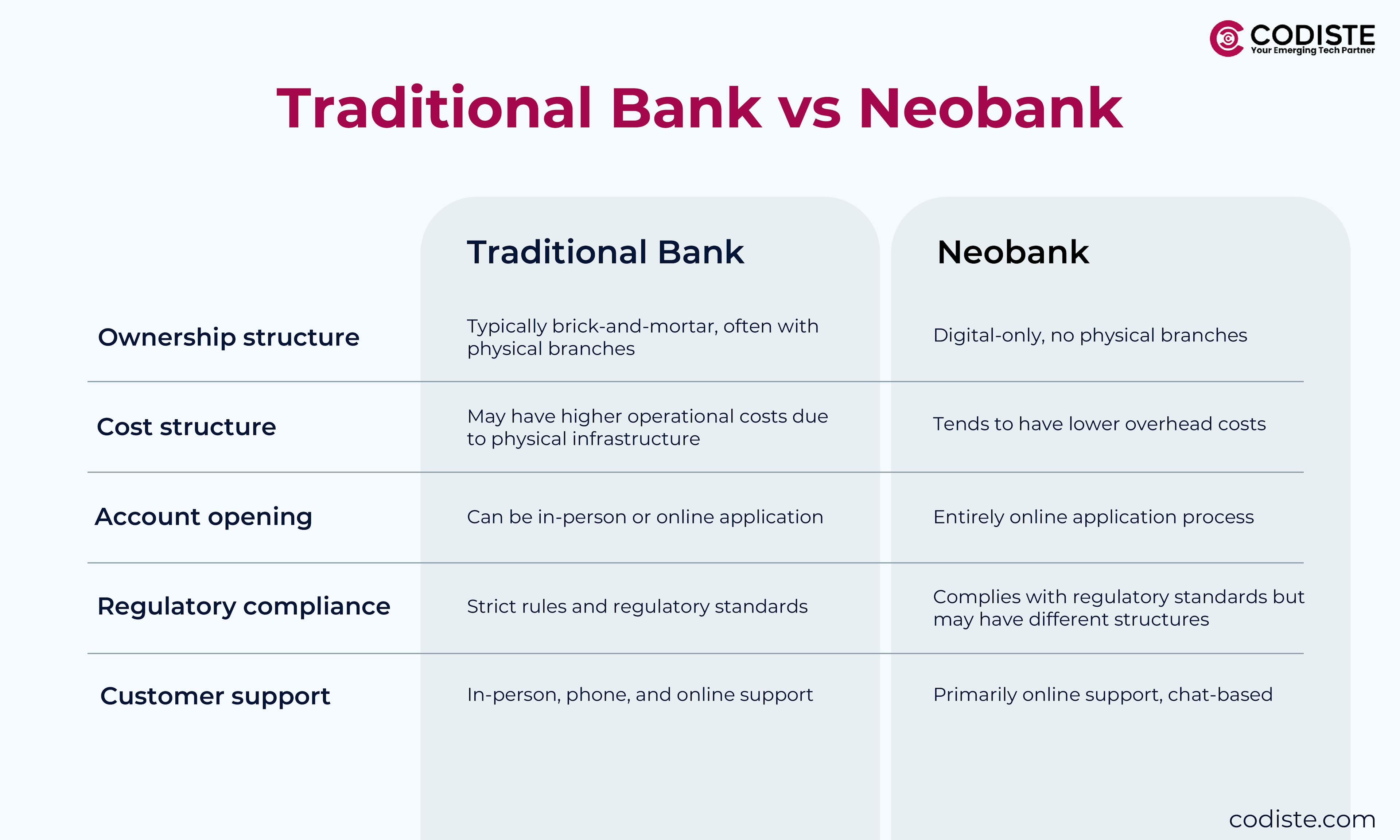

Neobanks vs Traditional Banks: Key Differences

Understanding the distinctions is essential before deciding. We break down the differences into four main categories.

Account Types, Fees, and Services

| Feature | Neobanks | Traditional Banks |

|---|---|---|

| Account Variety | Basic checking and savings accounts; limited or no loan/mortgage offerings | Full suite: checking, savings, mortgages, loans, credit cards, investments |

| Fees | Low or zero fees on accounts, transactions, withdrawals | Typically higher fees including monthly maintenance, overdrafts, ATM fees |

| Interest Rates | Higher Annual Percentage Yields (APYs) on savings | Lower APYs on deposits |

Neobanks cater to users needing straightforward banking, while traditional banks offer a broad range for complex financial needs (source; firstcomcu.org).

Accessibility and Convenience

- Neobanks: Entirely online via apps or websites, accessible 24/7 with no branches or in-person visits.

- Traditional Banks: Physical branches and ATM networks allow for cash handling, deposits, and personal interactions during business hours.

Choosing between an all-digital or hybrid access model is a major lifestyle consideration (source; emarketer.com).

The digital payment aspects and trends related to these accessibility models are further explored in digital payments trends 2023.

Security Measures and Regulation

- Neobanks: Typically partner with fully chartered banks to offer FDIC insurance on deposits and employ robust digital security, including Know Your Customer (KYC) procedures and encryption.

- Traditional Banks: Are directly licensed and FDIC insured institutions with a long-standing reputation, strong regulatory oversight, and trust built over decades.

Both maintain strong security but differ in regulatory presence and customer perceptions (source).

For a deeper dive into KYC provider options relevant for neobanks and fintechs, see KYC providers comparison.

Customer Support and User Experience

- Neobanks: Focus on fast, app-based chat support available 24/7; interfaces optimized for ease of use and personalization via AI.

- Traditional Banks: Offer personalized in-branch and phone support but often slower response times.

Neobanks prioritize speed and automation, while traditional banks emphasize personalized service, which can mean a trade-off in convenience versus human connection (source).

Pros and Cons

Traditional Banks:

- Pros: Wide range of products, access to branches and ATMs, trusted and proven institutions

- Cons: Higher fees, lower interest rates on deposit accounts

Neobanks:

- Pros: Low to no fees, higher interest rates, 24/7 app convenience, innovative features

- Cons: No physical branches, cash deposit limitations, fewer loan and mortgage options

This balance highlights critical online banking pros cons you should assess relative to your needs (source).

Digital Bank Comparison: Feature-by-Feature Analysis of Leading Neobanks

Let’s examine the features of the best neobank options like SoFi compared against traditional bank standards.

Fee Structures

- Neobanks like SoFi: No monthly maintenance fees, no minimum balance requirements, avoiding common charges that traditional banks levy (source).

- Traditional Banks: Often charge monthly account fees or require minimum balances, adding hidden costs to banking.

App Functionality

- Best Neobank Apps: Focus on intuitive user interfaces, 24/7 accessibility, and AI-driven personalized insights helping users manage budgets and expenses (source).

- Traditional Banks’ Apps: While functional, they often lack the smooth design and innovations found in neobank apps (source).

Interest Rates on Deposits

Neobanks provide higher APYs as they pass savings from lower overhead to customers.

Traditional banks typically offer far lower rates on savings and checking accounts, with profits relying on fees and loan interests (source).

International Use

- Neobanks facilitate app-based international transfers with reduced foreign exchange fees.

- Traditional banks generally charge expensive fees for wire transfers and currency exchange (source).

Customer Service

- Neobanks employ quick digital chat support available anytime, focusing on seamless, tech-enabled user assistance.

- Traditional banks provide slower, relationship-based service via phones or branches, which benefits those who value personal contact over speed (source).

Real-World Example: SoFi versus a Traditional Bank

- Onboarding: SoFi allows customers to open an account in minutes with minimal paperwork, compared to days of form-filling and credit checks at traditional banks (source).

- User Experience: SoFi’s app personalizes budgeting tips using AI, easily scheduling payments and tracking spending, while traditional banks might rely on web portals with more limited tools.

- Cost Savings: SoFi customers avoid monthly fees and enjoy better yield on savings accounts; traditional banks often balance lower rates with higher fees.

Online Banking Pros and Cons: What You Need to Know

Advantages of Online/Digital Banking

- 24/7 convenience allows banking anytime from anywhere without branch visits (source).

- Usually lower fees or no fees save customers money compared to traditional banks with multiple service charges (source).

- User-friendly mobile apps streamline payments, transfers, deposits, and budgeting, reducing the time spent on banking (source).

Drawbacks of Online Banking

- No physical presence limits services requiring cash handling or complex consultations (source).

- Digital security risks exist despite strong KYC and encryption—users must remain vigilant (source).

- Limited product portfolios mean no mortgages or business loans, unlike traditional full-service banks (source).

These online banking pros cons should be considered carefully in the context of your personal financial needs and lifestyle. For security trends broadly affecting fintech and digital finance including neobanks, refer to top cybersecurity trends 2025 insights.

How to Choose Between a Neobank and a Traditional Bank

Lifestyle and Financial Needs Matter

- Choose Neobanks if you:

- Are tech-savvy and comfortable banking via apps

- Want low fees and simple checking/savings products

- Travel often and need easy international transfers (source)

- Prefer quick account setup and digital convenience

- Choose Traditional Banks if you:

- Require in-person banking support, including cash deposits

- Need comprehensive financial products, such as mortgages or business loans

- Value established trust and branch access (source)

Practical Tips for Testing Neobanks

- Start with small deposits to explore app usability and performance.

- Confirm FDIC insurance through the neobank’s partner chartered bank.

- Transition direct deposits and automated bill payments gradually to avoid disruptions (source).

By considering these factors, you can make an informed decision tailored to your daily banking habits and long-term goals.

Conclusion: Making the Right Bank Choice For You

In the neobanks vs traditional banks debate, neither is universally better—it depends on what you prioritize.

- Neobanks shine with low fees, digital convenience, innovative features, and high-yield savings accounts.

- Traditional banks provide trusted reliability, comprehensive financial products, and the tangible benefits of physical branches.

If you value cash access and in-person help, a traditional bank is best. If you want quick access, lower costs, and 24/7 app usage, look into the best neobank options. Conduct your own digital bank comparison to find the perfect match for your financial lifestyle.

Call to Action

Stay updated on the latest banking trends and fintech innovations by subscribing to our newsletter. Have a story about your experiences with neobanks vs traditional banks? Share your thoughts and help others navigate their banking choices by commenting below!

Frequently Asked Questions

- What exactly are neobanks and how do they differ from traditional banks?

Neobanks are digital-first financial institutions offering online-only banking services without physical branches. Traditional banks have physical locations and broader product ranges, while neobanks focus on streamlined, lower-cost digital options.

- Are neobank accounts FDIC insured?

Yes, most neobanks partner with fully chartered banks to provide FDIC insurance for deposits, just like traditional banks.

- What are the main advantages of choosing a neobank?

Neobanks typically offer low or no fees, higher interest rates on savings, 24/7 app access, and modern financial tools powered by AI for budgeting and expense tracking.

- When should I stick with a traditional bank?

If you need extensive financial products like mortgages, in-person support, or cash handling facilities, traditional banks are the preferred choice.

- How can I safely try out a neobank?

Start by making small deposits, verifying FDIC insurance, and gradually moving direct deposits and bill payments to avoid any interruptions.

References:

- https://www.sofi.com/learn/content/neobanks-vs-traditional-banks/

- https://diro.io/neo-banks-vs-traditional-banks/

- https://www.firstcomcu.org/post/neo_banks_vs_traditional_banking__know_the_difference.html

- https://www.emarketer.com/learningcenter/guides/neobanks-explained-list/

- https://techcirclenow.com/fintech-regulations-automation-trends

- https://techcirclenow.com/harnessing-generative-ai-tools-productivity

- https://techcirclenow.com/digital-payments-trends-2023

- https://techcirclenow.com/kyc-providers-comparison-onfido-sumsub

- https://techcirclenow.com/top-cybersecurity-trends-2025-insights

Thank you for reading! Your ideal bank is just a decision away. Whether digital-first or branch-backed, the right bank supports your financial goals securely and conveniently.